Tax: Guide to Tax and Corporation Tax Return UK

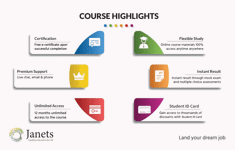

15 Courses Bundle | CPD Certified | 150 CPD Points | Free QLS Hardcopy Certificates | Tutor Support | Lifetime Access

Janets

Summary

- CPD Accredited PDF Certificate - Free

- CPD Accredited Hard Copy Certificate - £15.99

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

In the intricate maze of taxation, countless individuals find themselves drowning in a sea of bewildering rules and ever-changing regulations. The frustration of navigating this fiscal labyrinth is no secret, with seemingly insurmountable hurdles at every turn. The importance of tax expertise transcends mere number-crunching; it's the bedrock of financial stability for individuals and the lifeblood of every business. Yet, understanding the intricacies of tax, and mastering the art of corporation tax return in the UK, is a challenge that often leads to missed opportunities and avoidable financial burdens.

Well, you have nothing to worry about this. In this very program, you will discover the significance of our Tax: Guide to Tax and Corporation Tax Return UK course. You'll not only gain insights into the dynamic world of tax accounting but also decipher the complexities of financial management and financial reporting. You'll delve deep into tax accounting, explore the dynamics of accounting and finance, and master the art of Xero Accounting and Bookkeeping. Moreover, you will navigate the Sage 50 Accounts confidently and understand the nuances of VAT, pension, and internal audit skills. You will then acquire the knowledge to manage purchase ledgers, conduct financial analysis, and grasp the fundamentals of financial management.

With this course, you'll not only gain knowledge but also the power to make informed financial decisions. Take charge of your financial future! The world of taxation and finance awaits your expertise!

Learning Outcome

By the end of this Tax: Guide to Tax and Corporation Tax Return UK course, you will be able to:

- Applying principles of tax accounting in your business or company.

- Develop expertise in accounting and finance, enabling you to make informed financial decisions.

- Master Xero Accounting and Bookkeeping for proficient financial record management.

- Gain skills in using Sage 50 Accounts for effective financial control and reporting.

- Understand the foundations of Value Added Tax (VAT) and its application in business transactions.

- Acquire the knowledge to manage pension schemes and related financial aspects competently.

- Develop a strong grasp of internal audit skills for compliance and risk management.

- Become a proficient financial investigator, skilled in uncovering financial irregularities.

- Learn to manage a purchase ledger efficiently, streamlining financial transactions.

- Enhance your financial analysis skills for interpreting and communicating financial data effectively.

- Attain a deep understanding of financial management fundamentals and their application in business operations.

- Gain comprehensive knowledge of HR, payroll, PAYE, and tax regulations and their application in a corporate context.

- Learn about financial reporting and how to prepare and analyse financial reports.

- Master financial modelling, using data to make strategic financial decisions.

- Proficiently use Microsoft Excel for data analysis and financial modelling.

CPD

Course media

Description

Through this all-in-one Tax: Guide to Tax and Corporation Tax Return UK course, we will take you through the dynamic world of finance and accounting. This program offers a rich array of courses to cultivate your expertise. You'll master the intricate art of Tax Accounting, honing your skills in financial management, auditing, and financial analysis. With specialised training in platforms like Xero Accounting and Sage 50 Accounts, you'll gain knowledge in bookkeeping and financial reporting, while delving into the nuances of VAT, pension management, and purchase ledger management.

This course goes beyond the numbers, developing your proficiency in HR, payroll, and PAYE, allowing you to navigate complex tax systems. It also equips you to uncover financial irregularities and fortify organisations against risk with Internal Audit Skills. Moreover, our Financial Modelling Training and Microsoft Excel course will enhance your analytical capabilities, making you a well-rounded Financial Reporting Manager. By the course's end, you'll be primed for success as you will have the ability to make informed, strategic financial decisions!

The Tax: Guide to Tax and Corporation Tax Return UK Bundle comes with one of our best-selling Tax Accounting courses endorsed by the Quality Licence Scheme with a FREE endorsed certificate along with 14 additional CPD Certified courses:

- Course 01: Accounting and Finance

- Course 02: Xero Accounting and Bookkeeping Training

- Course 03: Sage 50 Accounts

- Course 04: Introduction to VAT

- Course 05: Internal Audit Skills

- Course 06: Pension

- Course 07: Financial Investigator

- Course 08: Purchase Ledger

- Course 09: Financial Analysis

- Course 10: Financial Management Fundamentals

- Course 11: HR, Payroll, PAYE, TAX

- Course 12: Financial Reporting Manager

- Course 13: Financial Modelling Training

- Course 14: Microsoft Excel

Who is this course for?

This Tax: Guide to Tax and Corporation Tax Return UK course is for:

- Aspiring finance professionals seeking a comprehensive education in accounting and finance.

- Business owners and entrepreneurs looking to manage their finances effectively.

- Individuals aiming to enhance their career prospects by gaining expertise in financial management.

- Employees in the finance and accounting sector wishing to expand their skillset.

- Anyone interested in understanding the intricacies of financial transactions and taxation in the UK.

Requirements

No prior qualifications are needed for Learners to enrol on this Bundle.

Career path

Here are a few careers you can opt for after completing the Tax: Guide to Tax and Corporation Tax Return UK course:

- Financial Analyst (£30,000 - £70,000)

- Tax Advisor (£25,000 - £65,000)

- Payroll Manager (£25,000 - £50,000)

- Forensic Accountant (£30,000 - £80,000)

- Internal Auditor (£25,000 - £60,000)

- Financial Reporting Manager (£40,000 - £90,000)

- Financial Modeller (£35,000 - £75,000)

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

CPD Accredited PDF Certificate

Digital certificate - Included

CPD Accredited Hard Copy Certificate

Hard copy certificate - £15.99

A physical, high-quality copy of your certificate will be printed and mailed to you for only £15.99.

For students within the United Kingdom, there will be no additional charge for postage and packaging. For students outside the United Kingdom, there will be an additional £10 fee for international shipping.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.